what percent is taken out of paycheck for taxes in massachusetts

What percent of paycheck goes to taxes in Massachusetts. Rates for 2022 are between 094 and 1437.

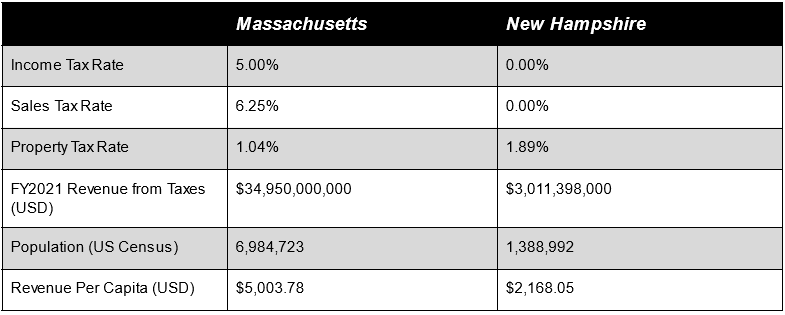

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

My pay is 63020 per.

. Total income taxes paid. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. The state-level payroll tax is 075 of taxable wage up to 137700 and the income tax is a flat rate of 5.

If you paid personal income taxes in Massachusetts in 2021 and file your Massachusetts tax return by September 15 2023 youll get a percentage of the nearly 3. 2 days agoThe jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread. Maximum Tax Rate for 2021 is 631 percent.

The first 15000 of an employees earnings each year is taxable for unemployment insurance. How much is being taken out of my paycheck for PFML. What percentage is taken out of your paycheck for taxes in Massachusetts.

Where Do Americans Get Their Financial Advice. 10 12 22 24 32 35 and 37. These are the rates for.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Rates are generally determined by legislation. A single filer will.

For tax year 2021 Massachusetts has a 50tax on both earned salaries wages tips commissions. Amount taken out of an average biweekly paycheck. What taxes are taken out of a paycheck in Texas 2021.

Your average tax rate is 1198 and your. Massachusetts is a flat tax state. Note that you can claim a tax credit of up to 54 for paying your Massachusetts.

The amount of federal and Massachusetts income tax withheld for the prior year. Minimum Tax Rate for 2021 is 031 percent. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

How much do you make after taxes in Massachusetts. The tax rate is 6 of the first 7000 of taxable income an employee earns annually. This will give you the percentage of tax that should be withheld for state and federal withholding tax.

Your bracket depends on your taxable income and filing status. Annually that amounts to. Total income taxes paid.

How much do they take out for taxes in Massachusetts. The first checks and direct deposits from 3 billion in excess tax revenue will head back to Massachusetts taxpayers starting Tuesday when the calendar officially changes to. Toll-free in Massachusetts 800 392-6089 9 am4 pm Monday through Friday more contact info Changes to IRS Form W-4 as of January 1 2020 Prior to the enactment in.

Massachusetts Hourly Paycheck Calculator. If your income varies then you will need to review the tax tables for. For every 100 you earn a maximum of 38 cents will be deducted for PFML.

See answer 1 Best Answer. Is mass tax exempt. There are seven federal tax brackets for the 2022 tax year.

You pay unemployment tax. Just enter the wages tax. Massachusetts Income Tax Calculator 2021 If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

Learn More About The Massachusetts State Tax Rate H R Block

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Flat Bonus Pay Calculator Flat Tax Rates Onpay

Massachusetts Graduated Income Tax Amendment Details Analysis

Tax Lien Law Haunts Massachusetts Property Owners

Payroll For North America Updates State Paid Family And Medical Leave Quest Oracle Community

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

Massachusetts Paycheck Calculator Smartasset

Business Advocates On New Payroll Tax For Paid Family Medical Leave You Re Going To Feel It Boston Herald

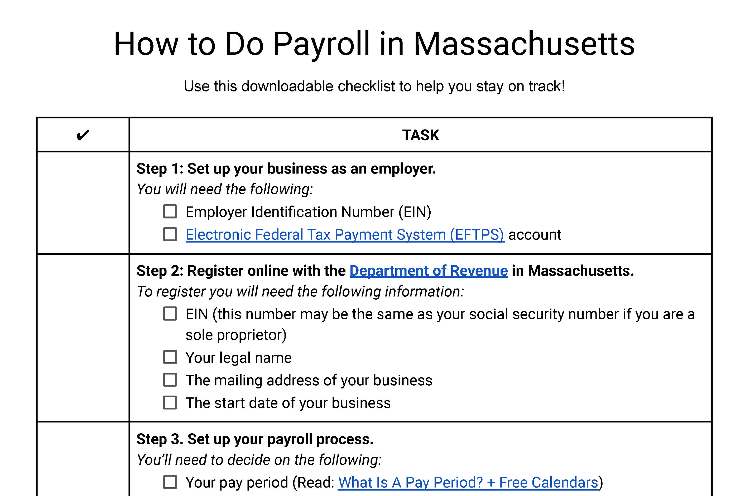

How To Do Payroll In Massachusetts What Every Employer Needs To Know

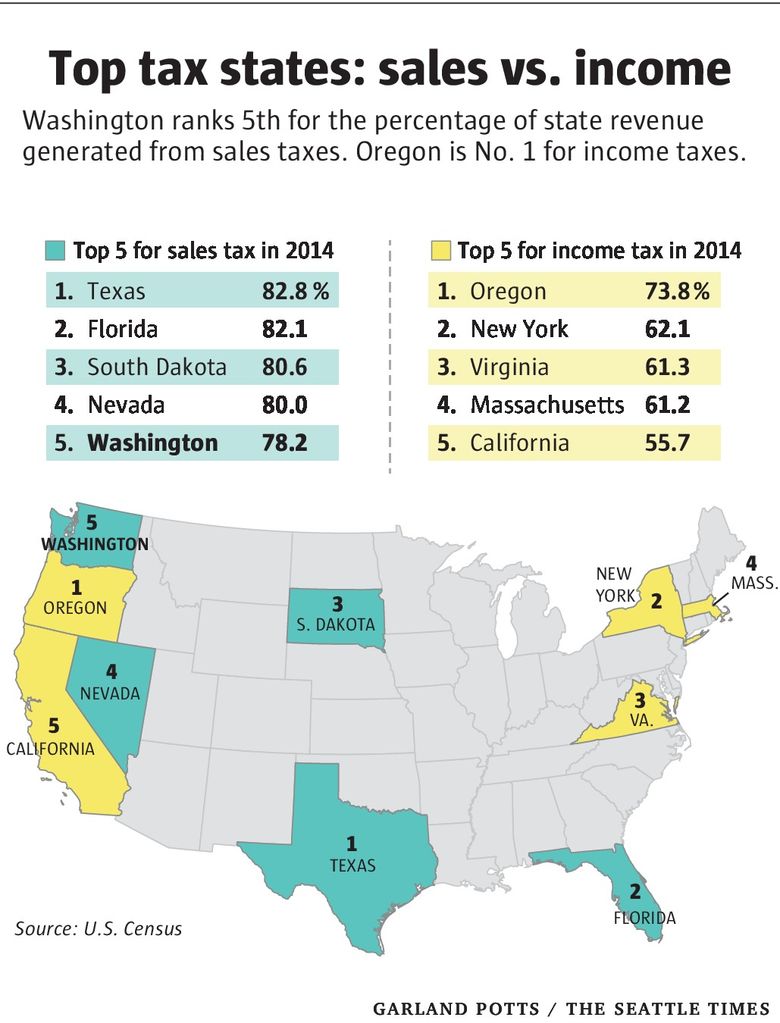

Taxes Like Texas Washington S System Among Nation S Most Unfair The Seattle Times

New Tax Law Take Home Pay Calculator For 75 000 Salary

Everything You Need To Know About Restaurant Taxes

Tax Lien Law Haunts Massachusetts Property Owners

State Withholding Form H R Block

Ma Low Income Workers Eligible For 500 This Month

Alabama Hourly Paycheck Calculator Gusto

Massachusetts Graduated Income Tax Amendment Details Analysis

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet